Understanding Credit Scores and How to Improve Yours

Learn what affects your credit score and discover practical steps to enhance it for better financial opportunities.

What is a Credit Score?

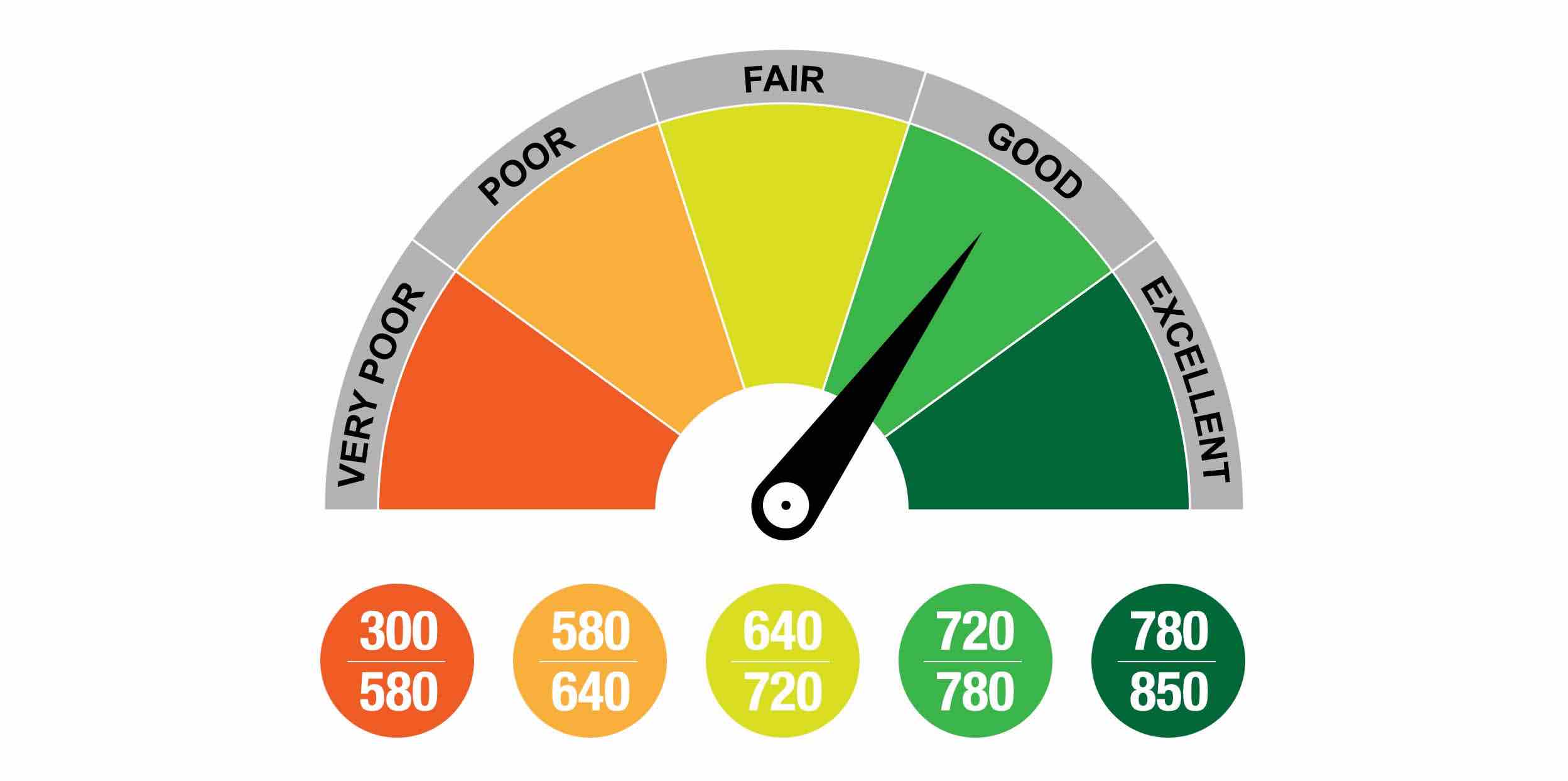

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. This score is derived from your credit report, which includes information about your credit history, such as the number of accounts you have, total levels of debt, and repayment history. Credit scores are crucial because they help lenders assess the risk of lending money or extending credit. A higher score indicates that you're a lower risk to lenders, potentially leading to better loan terms and interest rates. Understanding your credit score is essential as it affects not only your ability to secure loans but also impacts renting an apartment or even landing certain jobs. The most commonly used credit scoring models are FICO and VantageScore, both of which weigh factors like payment history, amounts owed, length of credit history, new credit, and types of credit used.

Factors Influencing Your Credit Score

Several factors contribute to your credit score, each carrying a different weight. The most significant factor is your payment history, accounting for about 35% of your score. Timely payments positively impact your score, while late payments can significantly harm it. The amounts owed is another critical factor, representing about 30% of your score. This is calculated based on your credit utilization ratio, which is the amount of credit you're using relative to your credit limits. The length of credit history accounts for around 15% of your score. Longer credit histories tend to boost your score, as they provide more data for lenders to assess your credit behavior. New credit and the types of credit you use also play roles, making up the remaining 20% of your score. Understanding these factors can help you make informed decisions to improve your credit score.

Checking Your Credit Score

Regularly checking your credit score is a good financial habit. It helps you understand where you stand financially and identify any inaccuracies that may be affecting your score. You're entitled to a free credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion—once a year. Reviewing your report can help you spot errors such as incorrect account information or fraudulent activities, which should be disputed immediately to prevent damage to your score. There are also several online services and financial apps that allow you to check your credit score for free. Monitoring your score over time can provide insights into how financial decisions impact your creditworthiness, enabling you to make adjustments as needed.

Strategies to Improve Your Credit Score

Improving your credit score requires a strategic approach and consistent effort. Start by ensuring you pay all your bills on time, as payment history is the most significant factor in your score. Consider setting up automatic payments or reminders to avoid missing due dates. Reducing your credit utilization ratio is another effective strategy. Aim to keep your balances below 30% of your credit limit. If possible, pay down existing debt and avoid accumulating new debt. Another tactic is to become an authorized user on a responsible person's credit card account, which can add positive history to your credit report. Additionally, avoid opening too many new accounts at once, as each application can slightly lower your score. Over time, these strategies can help enhance your credit score, making you more attractive to lenders.

Managing Debt Responsibly

Responsible debt management is crucial for maintaining and improving your credit score. Start by creating a budget that prioritizes debt repayment, focusing on high-interest debts first. The debt snowball or debt avalanche methods can be effective strategies for debt reduction. The debt snowball method involves paying off smaller debts first to build momentum, while the debt avalanche method targets high-interest debts first to save money on interest. Both methods require discipline and commitment but can significantly impact your overall financial health. Additionally, avoid maxing out your credit cards, as high balances can negatively affect your credit score. By managing your debt responsibly, you not only improve your credit score but also achieve greater financial stability and freedom.

The Long-term Benefits of a Good Credit Score

A good credit score offers numerous long-term benefits that can enhance your financial well-being. It can lead to lower interest rates on loans and credit cards, saving you money over time. A strong credit score can also improve your chances of being approved for loans, credit cards, and rental applications. In some cases, it may even influence job opportunities, as employers may view a good credit score as a sign of reliability and responsibility. Additionally, insurance companies might offer better rates to individuals with higher credit scores. By understanding and actively working to improve your credit score, you set yourself up for a more secure financial future, with access to better financial products and services.