How to Improve Your Credit Score

Learn effective strategies to boost your credit score, from timely payments to reducing debt, and unlock better financial opportunities.

Understanding Your Credit Score

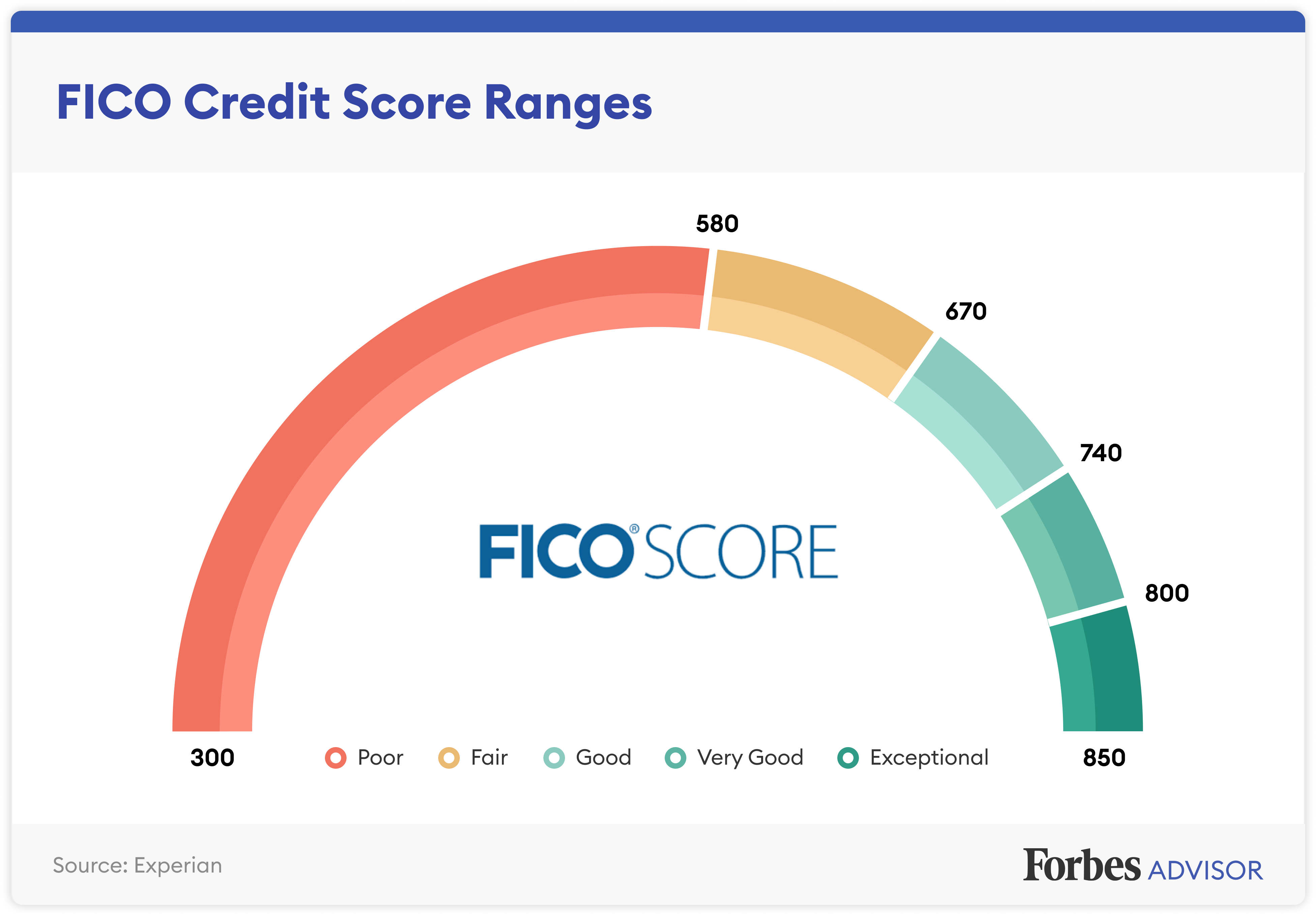

Your credit score is a three-digit number that represents your creditworthiness. Lenders use this score to determine the risk of lending you money. A higher score means you are seen as less risky, which can result in better interest rates and loan terms. There are several factors that influence your credit score, including your payment history, the amount of debt you owe, the length of your credit history, new credit inquiries, and the types of credit you use. Understanding these factors is the first step toward improving your credit score. By focusing on the areas that need improvement, you can take strategic actions to boost your score over time.

Paying Your Bills on Time

One of the most critical factors in determining your credit score is your payment history. Late payments can significantly lower your score, while consistent, on-time payments can help improve it. To ensure you never miss a payment, consider setting up automatic payments or reminders. If you have missed payments in the past, it's essential to get current and stay current. Over time, the impact of missed payments will diminish, especially if you establish a pattern of timely payments. Remember, even one missed payment can have a lasting effect, so prioritize paying your bills on time.

Reducing Your Debt

The amount of debt you owe, also known as your credit utilization ratio, is another significant factor in your credit score. This ratio compares your total credit card balances to your total credit limits. A lower ratio is better for your credit score. Aim to keep your credit utilization below 30%, but the lower, the better. Start by paying down high-interest debt first, and consider consolidating your debts if it helps you manage them more effectively. Reducing your overall debt not only improves your credit score but also enhances your financial health.

Length of Credit History

The length of your credit history accounts for a portion of your credit score. Generally, a longer credit history is better because it provides more information about your financial behavior. To improve this aspect of your score, keep older accounts open even if you don't use them regularly. Closing old accounts can shorten your credit history and reduce your available credit, both of which can negatively impact your score. Additionally, avoid opening too many new accounts in a short period, as this can lower the average age of your accounts.

Managing New Credit Inquiries

When you apply for new credit, a hard inquiry is recorded on your credit report. Multiple hard inquiries in a short period can lower your credit score because they indicate that you may be taking on new debt. To manage this, try to limit the number of new credit applications you submit. If you're shopping for a mortgage or auto loan, multiple inquiries within a short time frame are typically treated as a single inquiry, so try to do your rate shopping within a concentrated period. This way, you can minimize the impact on your credit score while still finding the best rates.

Diversifying Your Credit Mix

Your credit mix refers to the different types of credit accounts you have, such as credit cards, installment loans, and mortgages. A diverse credit mix can positively impact your credit score because it shows lenders that you can manage different types of credit responsibly. However, don't open new accounts just to diversify your credit mix, especially if it leads to unnecessary debt. Instead, focus on maintaining a healthy balance of credit types that fit your financial situation. Over time, a well-managed credit mix can contribute to a higher credit score.